How to Invest in China’s Stock Market from India (2026 Guide)

Routes, rules, taxes, ETFs, risks, examples & a practical timeline

If you are based in India and want to invest in China’s stock market, you can do so through Indian mutual funds/ETFs, overseas brokers (under RBI’s LRS), US-listed ADRs of Chinese companies, and China-focused ETFs listed in the US/HK/Europe.

Your choice should balance costs, access, latest Indian tax rules, and China-specific market risks.

Quick 5-Step Checklist: How to Start Investing in China from India

- Choose your route: India-domiciled China ETFs / international funds, overseas broker under LRS, ADRs, or UCITS China ETFs.

- Check LRS & tax rules: LRS eligibility, TCS thresholds, updated LTCG/STCG regime, dividend WHT, and Form 67 for FTC.

- Open the right account: Demat for India-listed ETFs; global account for overseas stocks/ETFs.

- Select the ETF/stock: Compare index fit, TER, domicile, currency & liquidity.

- Start small & rebalance: Track regulations, currency movements, ADR/VIE risks.

Simplified Guide on How to Invest in the China Stock Market from India

1. Indirect Investment via International Equity Funds

International equity funds (e.g., Aequitas International Equity Fund) invest globally, including China.

- Expert-managed

- Diversified

- No foreign account setup

2. Open a Global Brokerage Account (LRS Route)

Choose a global platform that provides access to China (HKEX) and US exchanges.

- Requires USD remittance under LRS

- FX + international brokerage fees apply

3. Invest via China-Focused ETFs

ETFs offer diversified exposure at low cost.

Available options:

- India-listed China ETFs

- US-listed China ETFs (MCHI, FXI, ASHR)

- UCITS China ETFs (Europe/HK)

4. Comply with RBI & Tax Rules

- LRS limit: USD 250,000 per FY

- TCS: As per updated thresholds

- Taxation: 12.5% LTCG (no indexation), STCG at slab for foreign shares, dividends taxed at slab

Quick Comparison: Different Ways to Invest in China from India

|

Investment Route |

Accessibility | Risk Level | Management Style | Costs | Regulation Compliance |

Suitable For |

| International Funds (e.g., Aequitas International Equity Fund) | Very High | Low–Moderate | Expert-managed | Moderate (1–2.5%) | SEBI/IFSCA compliant | Beginners, passive investors |

| China-focused ETFs | High | Low | Passive | Low (0.5–1%) | Under LRS (if overseas) | DIY, cost-conscious investors |

| Direct Stock Trading (Global Broker) | Moderate | Moderate–High | Self-managed | Variable (FX, brokerage, ADR fees) | LRS + foreign KYC | Advanced investors/traders |

Click to explore Aequitas International Equity Fund in Chinese Equities

🇨🇳 All Legal Ways Indians Can Invest in Chinese Stocks

Note: LRS applies only to resident individuals. NRIs must use non-resident investment routes

1. India-Domiciled Mutual Funds / ETFs / FoFs

- Invest in HK/China indices (e.g., Hang Seng TECH)

- Costs: TER + ETF spread

- Tax: LTCG 12.5%, STCG 20% (Sec 111A for STT funds), 50AA for FoFs

- Good for: Beginner investors

- Caveat: Overseas investment cap limits for AMCs

2. Overseas Brokerage (Under LRS)

- Buy HK-listed stocks, US-listed China ADRs, or global China ETFs

- Costs: FX conversion, remittance bank fees, brokerage, ADR fees

- Tax: Foreign shares/ETFs LTCG 12.5%; STCG slab; dividends at slab (FTC via Form 67)

- Good for: Investors seeking broader access

- Caveat: LRS/TCS compliance, currency risk

3. US-Listed ADRs of Chinese Companies

- Convenient access to major companies (BABA, JD, PDD)

- Risk: VIE structure, delisting concerns, PCAOB audit access

- Costs: ADR fees

- Good for: Investors familiar with US markets

4. UCITS / Hong Kong China ETFs

- IE/LU domiciled diversified ETFs with tax efficiency

- Costs: TER + FX + brokerage

- Good for: Long-term diversified exposure

5. GIFT City / IFSC Platforms

- Global investing via IFSC brokers

- Costs: Brokerage + FX + remittance charges

- Good for: Investors wanting lower friction global access

Detailed Breakdown – Chinese Investment Routes for Indian Residents

NRIs note: RBI’s Liberalised Remittance Scheme (LRS) is for resident individuals; NRIs must use non‑resident routes in their country of residence. Reserve Bank of India

Why Funds/ETFs Are Often Easiest

- Broad exposure (reducing single-stock risk)

- Simplified corporate actions

- No remittance setup required

- Low operational complexity

Quick Answers

- Fastest route (retail‑friendly): India‑domiciled international funds/ETFs that track China or Hong Kong indices (e.g., Hang Seng TECH). Easy KYC, INR‑denominated; taxation as per Indian mutual‑fund/tax rules.

- Broader menu & direct stocks: Open a global trading account via your Indian bank/broker’s overseas partner or a global brokerage and remit under RBI’s LRS (USD 250,000 per FY cap). Buy HK‑listed shares, US‑listed Chinese ADRs, or China ETFs. TCS applies above thresholds; see tax section.

Why Invest in China Stocks?

China boasts one of the largest economies in the world, driven by rapid industrialization, technological advancements, and a burgeoning middle class. Here’s why investing in China stocks makes sense:

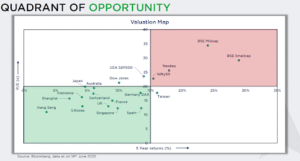

Lucrative Valuations:

Prolonged underperformance combined with depressed headline valuations means Far East markets, especially Hang Seng listed equities, provide a favorable risk-reward scenario.

Ahead of the Bull run :

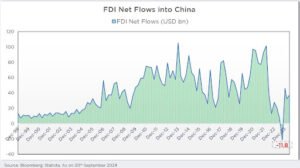

In the Q3CY23, inward FDI flows became negative for the first time since the start of the published timeline in 1998 and have turned positive since, showcasing renewed investor sentiment.

Domestic Consumption :

China’s shift from an export-led growth provides massive opportunities for domestic consumption. Despite several economic upheavals, retail consumption has grown at ~11% CAGR over 20-yrs

Better priced than peers :

Larger companies, available at lower price, compared to Indian peers.

Economic Growth :

China’s GDP growth consistently outpaces many other major economies, making it an attractive investment destination.

Sector Diversity :

From technology giants like Alibaba and Tencent to rapidly expanding healthcare and green energy sectors, the market offers diverse investment options

Global Market Integration :

With initiatives like the Stock Connect program, investing in China stocks has become more accessible for global investors.

China share classes & where they trade (know what you’re buying)

- A‑shares: Mainland‑listed (Shanghai/Shenzhen), CNY/CNH, largely accessed by foreigners via Stock Connect or QFII (institutional).

- H‑shares/Red‑chips/P‑chips: Chinese companies listed in Hong Kong (HKEX) in HKD (H‑shares are incorporated in mainland China; red/p‑chips are incorporated offshore but China‑operating). Many popular China ETFs and India‑available China funds track Hong Kong indices (e.g., HSCEI, HSTECH).

- B‑shares: Mainland exchanges in foreign currency (smaller/free‑float). Most global investors use ETFs instead. Context only.

- ADRs: US‑listed receipts of Chinese companies (e.g., BABA, JD). ADRs carry depositary fees and, for many internet platforms, VIE structure risk.

LRS, TCS and taxes for China investing (India rules)

RBI’s Liberalised Remittance Scheme (LRS)

- Limit: USD 250,000 per financial year per resident individual for permissible current/capital account transactions (includes foreign securities).

- TCS under LRS: Government clarified the 20% TCS on certain outward remittances and revised thresholds in 2023; check your bank’s categorisation and exemption thresholds before remitting (credit against final tax due is available when you file returns).

Capital‑gains (effective after Budget 2024 changes)

- Long‑term capital gains (most assets, including foreign shares/ETFs): 12.5% without indexation (holding period norms unchanged—e.g., >24 months for unlisted shares/most non‑equity).

- Short‑term capital gains:

- Specified Mutual Funds (≤35% domestic equity, e.g., many international FoFs): gains on investments on/after 1 Apr 2023 taxed at slab regardless of holding period (Section 50AA).

Dividends & foreign withholding

- Dividends from foreign companies are taxed in India at your slab rate; claim Foreign Tax Credit (FTC) for withholding tax (e.g., PRC dividend WHT is typically 10%; claim via Rule 128 / Form 67).

Costs you’ll actually pay

- Bank FX & Remittance charges (AD bank schedule + GST); broker commissions; ETF TER; ADR depositary fees if you own ADRs. Check your bank’s remittance fee page and the ADR depositary’s fee disclosures.

This is general information—not tax advice.

Please consult a tax professional for your specific case.

China Exposure via Indices & ETFs (what’s inside, what it costs)

Major China indices you’ll see inside funds

- MSCI China: Large/mid caps across share classes available to intl investors (incl. H‑shares, red/p‑chips, ADRs, and A‑shares via Connect).

- FTSE China 50 (HSCEI/large caps in HK): Focus on the 50 largest HK‑traded Chinese companies—used by FXI.

- CSI 300 (A‑shares): 300 large/mid on Shanghai/Shenzhen

- Hang Seng TECH / China Enterprises (HSCEI): Tech‑tilted HK leaders; Mainland enterprises listed in HK.

Popular ETF examples (illustrative; verify access with your platform)

|

ETF |

Index focus |

Domicile/listing |

| iShares MSCI China (MCHI) | Broad China large/mid (incl. Connect/ADRs) | US (NYSE) |

| iShares China Large‑Cap (FXI) | FTSE China 50 (HK large caps) | US (NYSE) |

| Xtrackers CSI 300 A‑Shares (ASHR) | Mainland A‑shares (CSI 300) | US (NYSE) |

| KraneShares CSI China Internet (KWEB) | Overseas‑listed China internet | US (NYSE) |

| Mirae Asset Hang Seng TECH ETF | Hang Seng TECH Total Return | India (NSE/BSE) |

| Nippon India ETF Hang Seng BeES | Hang Seng Index | India (NSE/BSE) |

| Edelweiss Greater China Equity Off‑shore FoF | Greater China (feeder) | India (FoF) |

*Performance is past performance, not a guarantee; always check the provider page for the most current data and methodology notes.

How to evaluate a China ETF quickly

- Index fit: Broad (MSCI China) vs. A‑shares (CSI 300) vs. HK large‑caps (FTSE China 50) vs. sector/thematic (internet/tech).

- Costs & tracking: TER, spread, and historical tracking error.

- Domicile & withholding: UCITS vs. US vs. HK; look‑through dividend WHT and any fund‑level taxes.

- Currency: USD vs. HKD vs. CNH vs. INR (hedged/unhedged).

- Liquidity: AUM/volume; avoid tiny funds.

Benefits of Investing in China Stock Market

Understanding the benefits can strengthen your decision to explore this market:

- High Growth Potential:

China is a leader in industries like e-commerce, AI, and renewable energy, offering long-term growth. - Currency Diversification :

Investments in Chinese yuan provide a hedge against rupee depreciation. - Global Exposure:

China stocks add geographical diversity to your portfolio, reducing reliance on Indian markets.

Click here if you are a HNI and wish to explore investing in China

China Market Risks and How to Manage Them

- Regulatory & policy: Sudden rule changes (sector crackdowns, listing rules), and audit access/HFCAA‑related enforcement for US‑listed names.

Mitigations: Prefer diversified funds (not single stocks); mix ADRs and HK‑listings; monitor PCAOB updates. - Currency risk (CNH/CNY vs. USD vs. INR): product currency and your base currency both matter.

Mitigations: Know the ETF’s currency; consider phased investing and rebalancing. - Geopolitical risk (US‑China, tariffs, export controls).

Mitigations: Keep China as a controlled sleeve within EM/global allocation; rebalance annually. - Market‑access/liquidity: Some share classes are less accessible; bid/ask spreads widen in stress.

Mitigations: Use liquid ETFs/indices; avoid small funds.

Should You Invest in China Now in 2026?

The year 2026 presents unique investment opportunities and challenges for investing in China.

- Positive Outlook:

Economic reforms and government support for high-growth industries enhance the appeal of China stock market investing. - Geopolitical Risks :

Trade tensions and regulatory changes are factors to monitor closely. - Expert Advice:

Opt for professional services through a registered & established fund house . You can also explore the international equity funds offered by Aequitas focusing on direct equity participation in China

Please consult a financial advisor for your specific case.

Pros and Cons of Investing in China

Pros

- Access to one of the world’s fastest-growing economies.

- Exposure to innovative industries like EVs and biotechnology.

- Favorable valuation of Chinese stocks compared to developed markets.

Cons

- Regulatory uncertainty in the Chinese market.

- Political tensions impacting investor confidence.

Read More: Understanding the Opportunities and Risks of Investing in China

Conclusion

Investing in China from India can be a strategic move for diversification and growth.

Whether you invest via ETFs, global brokers, or expert-managed international funds, ensure you understand LRS rules, taxation, risks, and index exposure.

Platforms like Aequitas provide efficient access to high-quality global equity opportunities.

FAQs on Investing in China from India (2026 Edition)

1. How can I invest in the China stock market from India?

You can invest through:

- India-domiciled international mutual funds/ETFs/FoFs (e.g., Hang Seng TECH ETF, China-focused FoFs)

- Overseas brokers under RBI’s LRS to buy HK-listed shares, US-listed Chinese ADRs, or China ETFs

- UCITS / Hong Kong–listed China ETFs through global platforms

- Expert-managed international equity funds, such as global funds offered through established AMCs

These are all legal under the Liberalised Remittance Scheme (LRS) with a USD 250,000 per FY limit for resident individuals.

2. Is it legal for Indians to invest in the China stock market?

Yes. Resident Indians can legally invest in foreign equities, including Chinese stocks, through:

- LRS (USD 250,000 per financial year)

- International funds/ETFs offered by Indian AMCs

NRIs cannot use LRS—they must invest via non-resident routes in their country of residence.

3. What is the easiest way to invest in China from India?

The simplest route is through India-domiciled mutual funds or ETFs that track Chinese indices (e.g., Hang Seng TECH, HSCEI).

These require:

- No LRS remittance

- No overseas brokerage setup

- INR-based investing with SIP options

Ideal for beginners.

4. How can I invest in China indirectly?

Indirect exposure can be taken through:

- International equity mutual funds

- Fund of Funds that invest in Greater China

- China-focused ETFs available on Indian or global markets

These products offer diversified exposure without the complexities of foreign account setup.

5. What taxes will I pay when investing in China?

Under India’s post-2024 tax regime:

- LTCG on most foreign securities: 12.5% (without indexation)

- STCG on non-STT assets (foreign shares/ETFs): taxed at slab rates

- Specified Mutual Funds (≤35% domestic equity): gains taxed at slab under Section 50AA

- Dividends: taxed at slab; foreign withholding (e.g., ~10% PRC WHT) can be claimed via Form 67 (Foreign Tax Credit)

Consult your tax adviser for personalized guidance.

6. Are Chinese ADRs safe to invest in?

ADRs are convenient but come with:

- Depositary fees

- VIE structure risks (common in China tech stocks)

- US audit compliance risks (PCAOB continues oversight post-2022)

Mitigation: diversify across ADRs + HK listings, avoid oversized single-stock positions.

7. What is the minimum amount required to invest?

- India-domiciled funds/ETFs: AMC-set minimums (as low as ₹100–₹500 for SIPs)

- Overseas brokers: depends on platform; some allow fractional investing

- ADR/ETF minimums: cost of 1 share/unit in USD/HKD

8. Which is better for China exposure—ETFs or direct stocks?

ETFs/funds suit most investors because they offer:

- Diversification across sectors (tech, EVs, healthcare, consumption)

- Lower single-stock governance and regulatory risk

- Simpler taxation and operational processes

Direct stocks require deeper research and acceptance of China-specific volatility.

9. What are the benefits of investing in China stocks?

Key advantages include:

- Access to one of the world’s fastest-growing economies

- Exposure to high-growth sectors like EVs, tech, AI, and green energy

- Attractive valuations vs Indian or US markets

- Portfolio diversification across geography and currency

10. What are the risks of investing in China stock markets?

Major risks include:

- Regulatory unpredictability and sector crackdowns

- Geopolitical tensions (US-China/India-China)

- Currency fluctuations (CNY/CNH vs USD/INR)

- VIE/ADR audit risks

- Market access or liquidity constraints

Mitigate through diversification and by using credible funds/ETFs.

11. Can I use my Indian brokerage account for Chinese stocks?

Most Indian brokers do not provide direct access to Shanghai/Shenzhen/Hong Kong exchanges.

However:

- Many offer international investing partnerships with global brokers

- Or you can access China exposure through India-domiciled ETFs/FoFs or Aequitas-style international funds

12. Should I invest in China now in 2026?

2026 offers both opportunities and risks:

Positive drivers:

- Renewed FDI inflows

- Government support for strategic industries

- Attractive valuations and recovery trends

Watchpoints:

- Policy interventions

- Currency swings

- Global trade environment

Consider using professionally managed international equity funds for balanced exposure.

13. Can HNIs invest in China?

Yes. HNIs can invest through:

- Global brokerage accounts (LRS route)

- PMS/international mandates

- International equity mutual funds

- Specialized China or EM equity strategies

14. Are China-focused ETFs available for Indian investors?

Yes. Investors can access:

- India-listed ETFs tracking Hang Seng TECH or China enterprises

- UCITS China ETFs via overseas brokers

- US-listed China ETFs (e.g., MCHI, FXI, ASHR, KWEB) through global platforms

They offer low-cost, diversified exposure to Chinese markets.

Disclaimer: Markets are risky and regulations evolve. This article is for education only and does not constitute investment or tax advice. Please consult your financial advisor for personalised guidance.

Please organise for some executive / member to reach out to me. Wish to make some investments in China traded ETF’s. I am based out of Indore – Madhya Pradesh..India