We focus on facts and fundamentals and ignore market narratives.

AIF: Alternative Investment Fund

Aequitas Global Value Fund - International Equity Fund for Indian & Global Investors

We are thrilled to introduce our new products under International Equity Funds, a restricted scheme (Non-Retail), open-ended Category III AIF under IFSCA (International Financial Services Centres Authority) FM regulations, managed by Aequitas Investments IFSC Private Limited, which is registered with IFSCA as a registered fund management entity (non-retail).

Global Opportunity by Aequitas Team

-

Aequitas Global Value Fund

A Category III open-ended AIF to invest in overlooked, undervalued & unloved direct equities in the US, Europe, Singapore, South Korea, Hong Kong & more. This fund is ideal for Indian residents seeking exposure to international equity markets.

-

Aequitas Global Value Offshore Fund

A Category III open-ended AIF focusing on overlooked & undervalued direct equities in the US, Europe, Singapore, South Korea, Hong Kong & more, offering global investors (NRIs, FPIs, FIIs, etc.) an excellent platform to build a deep-valued portfolio.

Connect with us..

Just like our conviction in long term investment strategy, we carry firm believe in building long term relationships with our investors.

That’s the reason we have inculcated a culture of 1-1 relationships to guide you along this journey, right from the beginning, from Day 0.

If you are interested, to know more about our offerings, fill in your details and our team will reach out to you at the earliest opportunity.

Building wealth for investors across the Globe

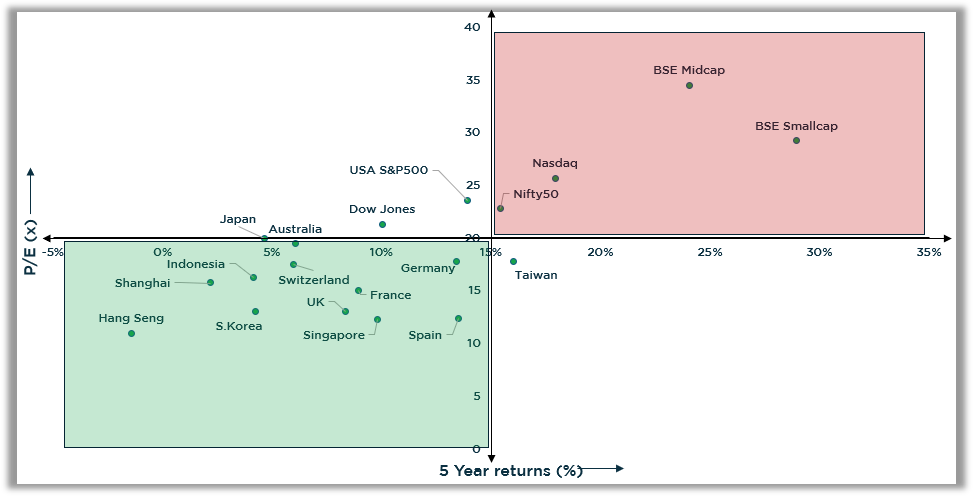

Hidden Bargains (Green Zone)

- Low P/E + Low Past Returns

Offering Higher upside potential with re-rating in future

Countries: Primarily, European, USA, Singapore, South Korea, Hang Seng, etc.

Valuation Risk Zone (Red Zone)

High P/E + High Past Returns

- May be overvalued & carry significant downside risk

BSE Midcap, Smallcap, Nasdaq, Nifty 50 have already seen strong rallies and now command rich valuations.

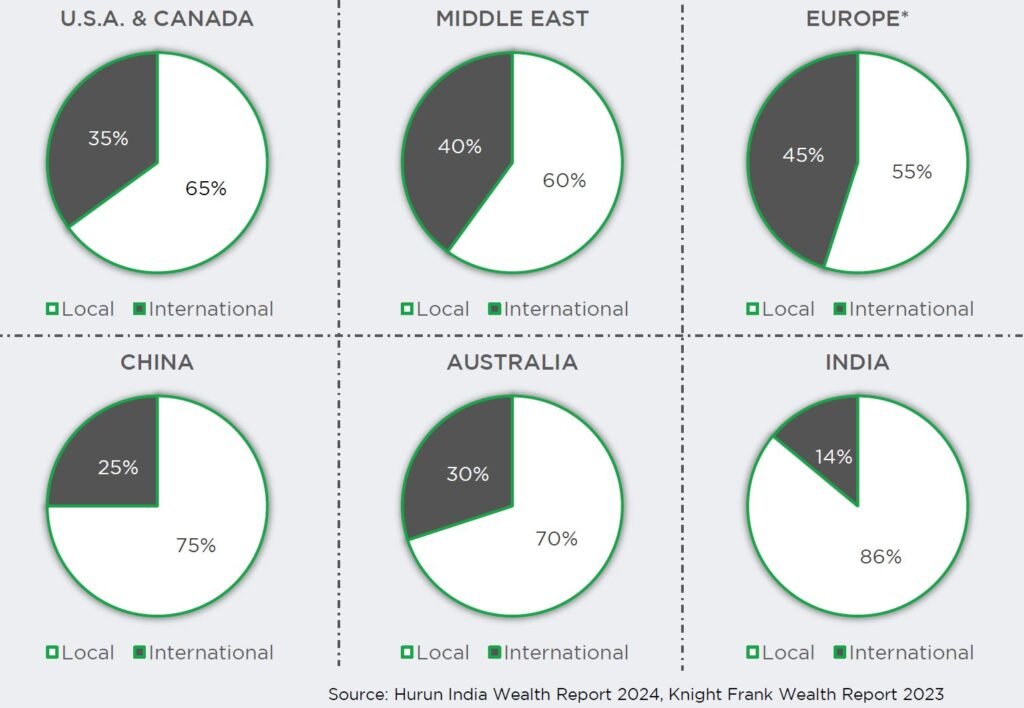

UHNI Wealth Allocation

- Despite their wealth, Indian UHNIs have under-invested globally, with only 14% allocation abroad—leaving their net worth vulnerable to single-market concentration risk, in case of local economic shocks.

- Major share of Indian investments are into real estate with equity accounting for less than 5%.

Why consider Going Global with Aequitas Global Value Fund?

DIVERSIFICATION

Avoid Single-Market Concentration Risk.

CURRENCY HEDGE

Protect your wealth against INR depreciation.

VALUE OPPORTUNITIES

Access global leaders at attractive valuations.

INSTITUTIONAL FRAMEWORK

Well-established regulatory structures & governance systems.

LOWER VOLATILITY

Lower implied volatility in developed markets.

DIVIDEND YIELDS

Access higher yields in global markets.

>>> GEOGRAPHY SPREAD<<<

GLOBAL BARGAINS, LOCAL PREMIUMS

Our new series strips away market noise to reveal where true value & wealth hides – be it Berlin or Bombay (Mumbai).

In the opening series, we discuss:

- Telecom

- Banking

- Footwear

- Automakers

- Supermarts

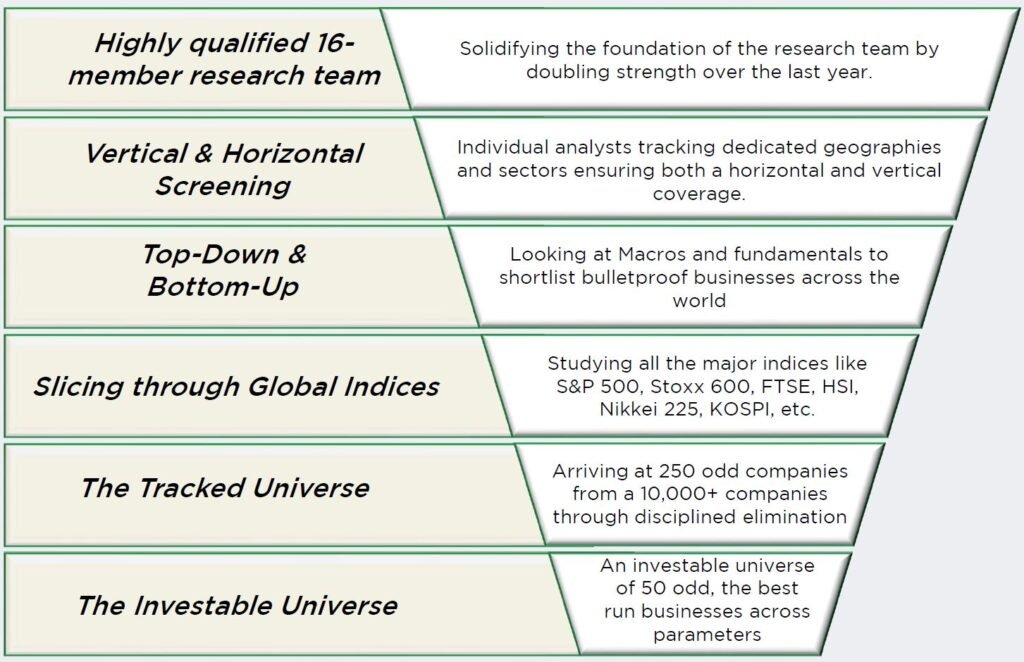

Our Approach

Investment Philosopy

Our investment philosophy is simple, we walk the talk. We believe that savings doesn’t create wealth for you, investing in the right manner does and through a carefully planned strategy, we deliver what we promise.

Focus & Discipline

-

-

We do not chase momentum or hot stocks.

-

We do not indulge in derivatives or IPOs.

-

We avoid leverage.

Multibagger Approach

-

Value: The valuation must be reasonable with a definite potential of re-rating soon.

-

Contrarian: We do things differently, which is a must to identify Multibaggers.

-

Growth: The company must have above average growth potential for the next 3-5 years.

Qualitative Analysis

-

Screeners: To analyze fundamental financial metrics

-

Research: We do our own primary research.

-

Portfolio Construction: Identify robust stocks, fit across all above parameters.

-

Ongoing research: Revisit the research timely to take informed decisions.

Portfolio Construction

-

We aim to construct a portfolio around quality stocks that are fundamentally strong, focusing on growth companies, with a horizon of 3-5 years in mind.

Selection Criterion

-

Industry Leaders

-

Low Debt

-

Good Management

-

Valuations

-

Creeping Acquisition/ Buy Backs

-

Cash Flow

Risks

-

Risk equates to what Ben Graham called a “permanent loss of capital”.

-

There are 3 risks that we particularly focus on:

- Valuation Risk

- Earnings Risk

- Balance Sheet Risk

The Outcome: A Portfolio built for the Future

Principal Officer, gift city

Subham Agarwal

After a successful kickstart to a career post-Chartered Accountancy course as an Investment Banker,

Subham Agarwal went onto pursue his career in Equity Investment in the listed space.

Having worked at Edelweiss and Investec India for over 4 years, in 2019, Subham joined the investment team of Aequitas with a deep understanding of varied sectors and valuations. With his entrepreneurial stint as Founder of Prep CA,

he is valued in the team for his fresh and rounded perspective on business challenges and processes.

Naturally curious about history and political dynamics, he is an avid reader.

In 2022, Aequitas launched the Offshore fund for International investors looking to invest in the Indian equity markets, and Subham took up the critical role as the Co-Fund Manager of the offshore fund.

Subham's profound interest and awareness of global events along with his tactical shrewdness to navigate market tides make him the right choice subsequently to lead Aequitas' Global Value Fund, as the Principal Officer.

International Equity Funds - FAQs

? What type of AIF is Aequitas’ Global Value Fund & Global Value Offshore Fund?

It is a long-only category III AIF, with exposure in only listed equities, with primary focus on public equities in Europe, US, etc.

? How is tax computed in this International Equity Fund?

Tax is computed at fund's end.

? Can NRIs or International investors invest in the fund?

Yes, NRIs and International investors can invest in the Aequitas Global Value Offshore Fund.

? Is there any lock-in period in AIF?

Yes, there is a 1-year lock-in period for resident Indians. However, there is no lock-in for Global investors (incl. NRI).

We are a leading investment firm with offices located in Mumbai, GIFT City & Dubai who specialize in global listed equity markets. Our clients comprise over a hundred UHNIs, family offices and global investors. With a net AUM of INR 80 bn., our 10-year CAGR of 28% (for PMS) has significantly outperformed the Nifty all along.

Contact

A-1003, The Capital Building, Behind ICICI Bank, BKC, Bandra -East, Mumbai -400051

-

info@aequitasindia.in

-

+91 72080 42953

-

Stay Updated. Stay Ahead