Author : Aequitas

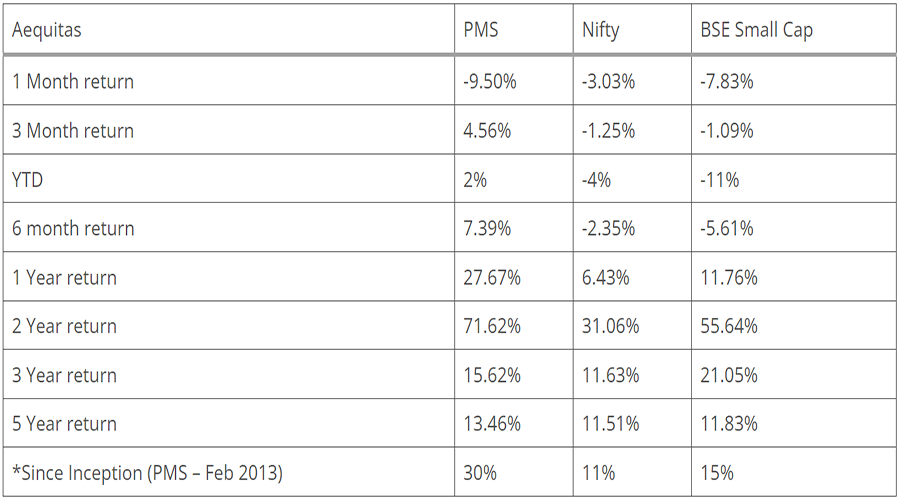

Note: The performance data is net of annual performance fees and expenses

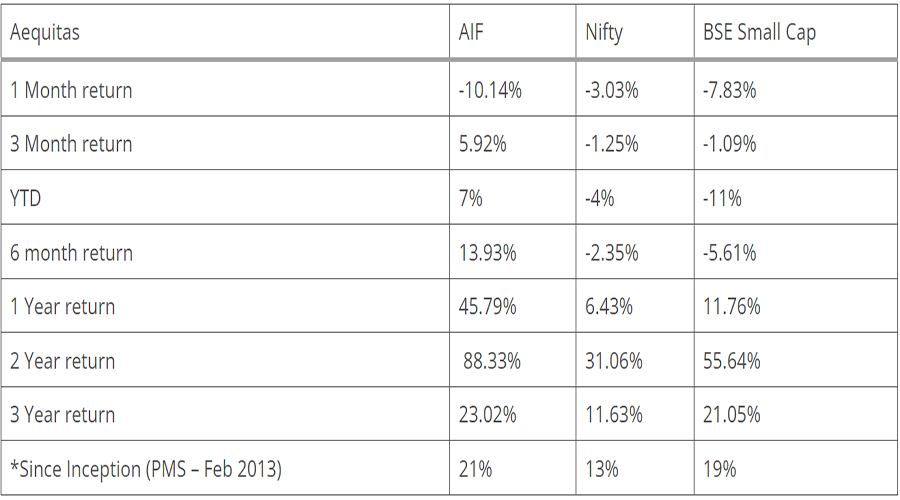

Note: The performance data is net of annual performance fees and expenses

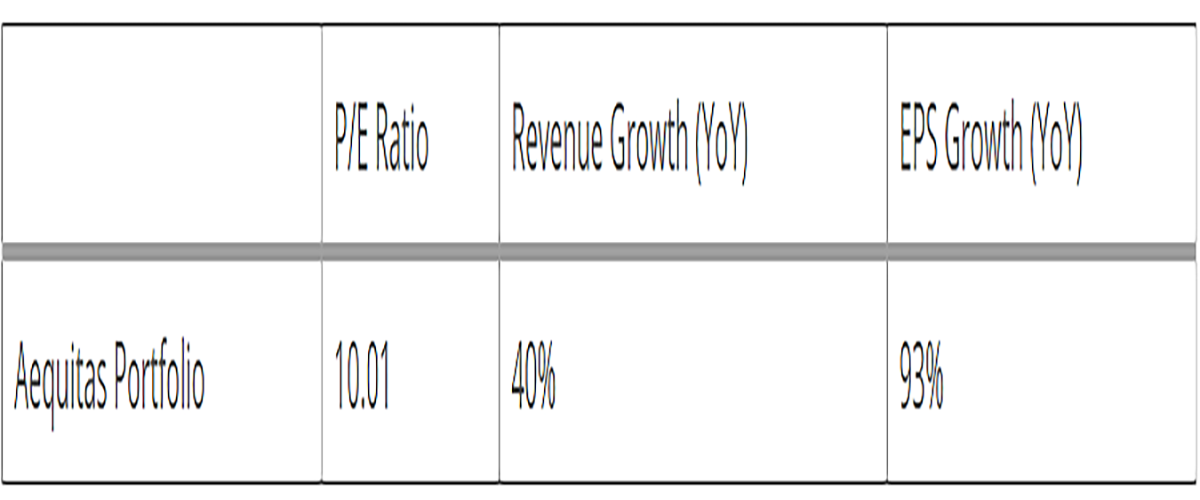

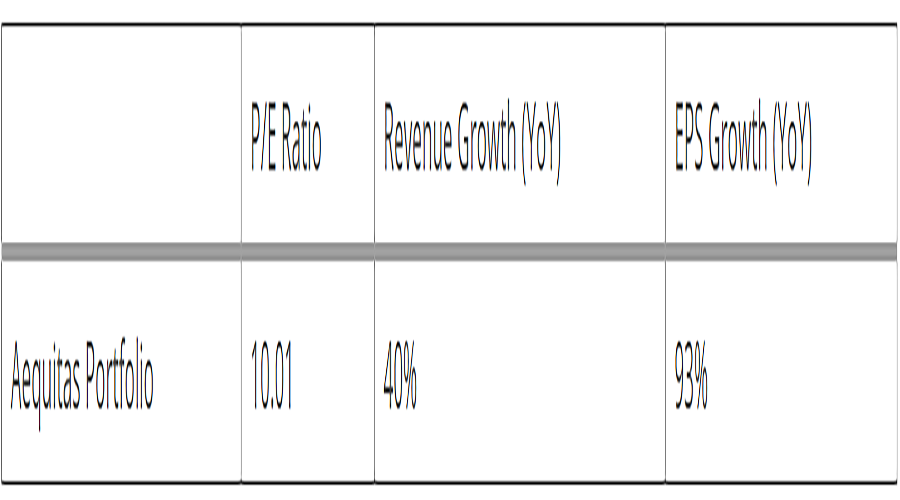

The good part about our portfolio was that the results were very good, however we too suffered the sell-off in May but are confident of bouncing back. Most of our portfolio companies are at single P/E multiples and have had healthy YoY Revenue and EPS growth.

The Month of May tested the patience of a lot of investors as we saw a lot of stocks get beaten across all Indices – some of them due to large FII holdings (which had pressed the Sell button), some due to results not coming as per expectations, some due to forward looking view not being as great as the year gone by and some due to governments knee-jerk reaction on Export levies and Quotas.

CORPORATE RESULTS

While the FIIs, for all probable reasons, sold off India due to the challenges they faced in Russian and Chinese markets, Indian Corporate health is as good as it has been since 2008. In a sample of more than 2700 Listed companies the average growth in profitability has been 9.7% of Sales. This has happened on the back of a lot of cost cutting, deleveraging and the companies moving to the 17% / 25% taxation regime.

A deleverage Balance sheet has made Indian Corporates primed for Capex, this is something that we are witnessing across sectors and augurs very well for Investors. While concerns will always remain on what’s next for market participants – we believe that our portfolio with overweight on Short Cycle Capex, Metals, Commodities and B2B Businesses is well positioned to take advantage of the economic situation.

DO WHAT THE FIIs DO!!!

The old wall street saying of “Sell in May and go away” came out true this May when we had the Worst FII selling since COVID in March 2020, where the FIIs sold off equities worth Rs.56,000 Crores (And came back very strong in the next 2 weeks).

A positive emergence of May 2022 FII redemption numbers was, despite the huge outflow of more than Rs. 40,000 Crores, the markets did not tank due to the resilience of the Domestic investors.

To give you all a historical perspective, FIIs sold Rs. 52,000 Crores in 2008 and the markets tanked by nearly 50% with the Sensex falling from a high of over 20,000 points in Jan 2008 to less than 8,000 points in March 2009.

Yes, the market levels were different so it’s not strictly an apple-to-apple comparison but even after considering the 3X market size over 2008 peak the fall has been contained to only 3%.

However, to have a better understanding of the impact that FIIs have historically had on the Indian markets, sharing with you the following table –

The table shows the total number of Months of FII investments going all the way from Jan 2002 till

date – the summary is as under –

● From Jan 2002 in the 245 months, we have had 169 months of positive FII inflows, of which Sensex gave a positive return in 125 months i.e., a whopping 74% times the Sensex returns were positive whenever the FIIs net bought equities in a month.

● In the same duration we have had 76 months of Negative FII inflows of which Sensex gave a negative return 67 times i.e., a whopping 88% times the Sensex returns were negative whenever the FIIs net sold equities in a month.

In essence for the average investor, it has always augured well for him when he has aligned his buys with the FIIs.

RESOURCE NATIONALISM

Resurgent demand aside, the world is reeling from 2 other challenges –

● Supply side constraints brought about earlier by COVID.

● The continued Chinese lockdown and natural resources constraint brought about by the Ukraine-Russia war.

While the Ukraine Russia War exacerbates the first – it is the degree of Resource Nationalism which we are looking out for.

While Russian oil and gas storyline is one which has been very well covered, within soft commodities, it all started with Ukraine and Russia not being able to export grain – Together before the war their exports were in the range of 28% of global exports of wheat, 29% of global exports of barley and 15% of maize. In response, the prices of grain have shot up leading to inflation. To quell inflation Governments across are pushing for Resource Nationalism by imposing export taxes / banning exports. We too, in India have seen the Government putting out an export quota for sugar and wheat.

Indonesia put out a ban for exporting palm oil – but retracted it in the next month for fear of losing out of precious foreign exchange. India too has put out export duties on crude steel & pellets.

Looking at Indonesian example of retraction of ban on palm oil exports and our earlier history (where in 2008 we again put out export levies on steel) we believe the Indian Government too will retract / reduce the export duties levied on crude / steel over the next 3-4 months, once WPI starts cooling off from its April high of 15.08% – which is the highest reading since December 1998.

We are carrying an ambitious target of $500 billion of exports for the year, which is much needed to maintain/ bridge the trade deficit which stood at approximately $200 billion last year. Given that energy prices have moved higher since last year, we will have to fire on all cylinders with a need to achieve a higher export number than our last year’s all time high of $418 billion.

We will be keenly looking forward to how the situation develops. Our portfolio valuation remains in Single digits. We remain committed to our thesis of –

● Capex coming back (focused on short term Capex Oriented companies).

● Commodities, Metals (Both in for a long-sustained ride).

● B2B companies (Remain committed to the Manufacturing story for India)

Let’s see how the story unravels!