A Detailed Guide to NRI Investment in Indian Stock Market – Can NRI Invest in Indian Stock Market?

Confused about how to invest in India as an NRI? This complete guide answers whether and how NRIs can invest in the Indian stock market effectively.

Key Takeaway Summary

- NRIs can legally invest in the Indian stock market through PIS-compliant accounts

- Popular NRI investment options include equities, mutual funds, real estate, and international equity funds

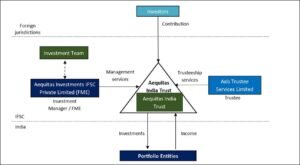

- Aequitas Offshore Fund offers NRI investors an opportunity to invest in Indian equity markets in an efficient manner

- NRI investors must comply with FEMA and RBI regulations

- Taxation and repatriation rules vary by investment type and location

Understanding NRI Investment in India

Who Qualifies as an NRI? Definition & Eligibility

According to the Income Tax Act, an NRI (Non-Resident Indian) is an Indian citizen or person of Indian origin who resides outside India for more than 182 days in a financial year.

Why Should NRIs Consider Investing in India?

- High GDP growth and expanding middle class

- Strong returns in equity markets compared to developed nations

- Advantageous currency exchange rates for USD, EUR, GBP

Benefits of NRI Investment in Indian Markets

- Access to emerging market opportunities

- Diversification of portfolios

Can NRI Invest in the Indian Stock Market?

Yes, NRIs can invest in Indian stock markets legally.

Legal Framework and Regulations for NRIs

NRIs must invest under the Portfolio Investment Scheme (PIS), regulated by the Reserve Bank of India (RBI). Only one account per person is allowed for PIS investing.

RBI Guidelines and FEMA Compliance

Investments must comply with Foreign Exchange Management Act (FEMA) rules. PIS approval must be obtained through designated banks.

Role of NRE/NRO/Demat Accounts

- NRE Account: For income earned outside India, fully repatriable

- NRO Account: For income earned in India (rents, dividends), repatriable with limits

- Demat & Trading Accounts: Must be opened with SEBI-registered brokers

Learn more from RBI’s Official PIS Guidelines

How NRI Can Invest in Indian Share Market – Step-by-Step Guide

Open an NRI Trading and Demat Account

- Choose a SEBI-registered broker

- Link your NRE/NRO account

- Submit KYC documents (passport, visa, PAN card, overseas address proof)

Choose Between Direct Equity or Mutual Funds

- Direct Equity: Requires active monitoring

- Mutual Funds: Professionally managed, diversified, suitable for passive investors

Use of Portfolio Investment Scheme (PIS)

- Mandatory for equity investments

- Helps report transactions to RBI

- Ensure your bank and broker are PIS-enabled

Taxation Rules for NRI Investors

Investment Type | Tax on Returns | Repatriation Limit |

Equity (long term) | 12.5% (>1-Yr. holding period) | Fully repatriable |

Equity (short term) | 20% | Fully repatriable |

Mutual Funds | Depends on fund type | Fully repatriable |

| NRO FD | 30% + surcharge | Up to USD 1 million/year |

A Smart Diversification Strategy: Aequitas Offshore Fund via GIFT City for NRIs

Why NRIs Should Consider India-Focused Offshore Investing

- Direct access to Indian equities through an international route

- Tax-efficient structure available under India’s GIFT City framework

- Simplified repatriation process and regulatory ease

Benefits of Investing in Aequitas Offshore Fund

- India-centric equity investment with offshore accessibility

- Structured to meet the needs of global NRIs and foreign investors

- Professionally managed by experienced fund managers at Aequitas

How Aequitas Caters to Global NRIs Looking to Invest in India

- Registered and regulated under International Financial Services Centre (IFSC) norms in GIFT City

- Designed for NRIs looking for India-based opportunities through a globally accessible fund structure

- Seamless onboarding, investor support, and performance-focused strategy

Explore Aequitas Offshore Fund via GIFT City to learn more about India-focused offshore investment opportunities.

A Detailed Guide to Gift City Investment

Top NRI Investment Options in India Beyond Stock Market

Real Estate

- High appreciation in Tier-1 & Tier-2 cities

- Can be held jointly with residents

Fixed Deposits

- NRE FDs: Tax-free in India

- NRO FDs: Taxable, but secure

Bonds & Government Securities

- Safe and suitable for conservative investors

Mutual Funds & ETFs

- Offers sectoral or diversified exposure

- Can be SIP-based for convenience

Best Investment Options for NRI in USA Looking at India

Cross-Border Investing Considerations

- Must comply with FATCA and US SEC regulations

- Choose fund houses with US compliance framework

Repatriation and Double Taxation Agreements

India has DTAA with over 90 countries, including the USA

Investment Advice for NRIs from USA

- Use tax-efficient routes like international equity funds

- Consider holding via NRE account for repatriation ease

Choosing the Right NRI Investment Services

How to Pick SEBI-Registered Investment Advisors

- Check registration details on SEBI’s official site

- Review client servicing capabilities

Robo-Advisory vs Full-Service Brokers

- Robo: Cost-effective, algorithm-driven

- Full-Service: Personalized portfolio support, ideal for high-net-worth NRIs

Importance of Personalized Investment Planning for NRIs

Each NRI’s goals, risk appetite, and country of residence are different. Tailored services ensure better outcomes.

FAQs on NRI Investments in India

Q1: Can NRIs invest in Indian stock market without PIS?

No. PIS approval from an RBI-authorized bank is required for direct equity investments by NRIs.

Q2: Can NRIs invest in Indian mutual funds and offshore funds?

Yes. NRIs can invest in mutual funds via NRE/NRO accounts. For India-focused offshore exposure, options like the Aequitas Offshore Fund via GIFT City are available.

Q3: What taxes do NRIs pay on equity investments?

NRIs pay 15% short-term capital gains tax and 10% long-term gains (above Rs. 1 lakh) on equities. TDS applies at source.

Q4: What are the benefits of investing via GIFT City-based offshore funds?

These offer tax-efficient investing, simplified repatriation, and direct access to Indian equities from global locations.

Q5: What is the best route for NRIs to repatriate investment returns?

Returns through NRE accounts are fully repatriable. For NRO accounts, use Form 15CA/CB for remittance up to USD 1 million/year.

Conclusion: The Best Way to Invest in India for NRI

NRI investments in India offer high potential when done compliantly and strategically. For global NRIs looking for direct exposure to Indian equities in a tax-efficient manner, the Aequitas Offshore Fund via GIFT City stands out as a robust and accessible investment route. Backed by professional fund management and a future-ready structure, it’s an ideal choice for NRIs aiming for long-term growth from India’s equity markets.