1. What is Portfolio Management Services in India?

Portfolio Management Services (PMS) in India refers to a specialised investment service offered by expert portfolio fund managers, focused at providing customised investment solutions to meet individual investment objectives based on risk tolerance, diversification, capital available to invest, etc.

While there are multiple portfolio management companies in India who offer this service, focusing on generating high returns through a well-diversified investment strategy.

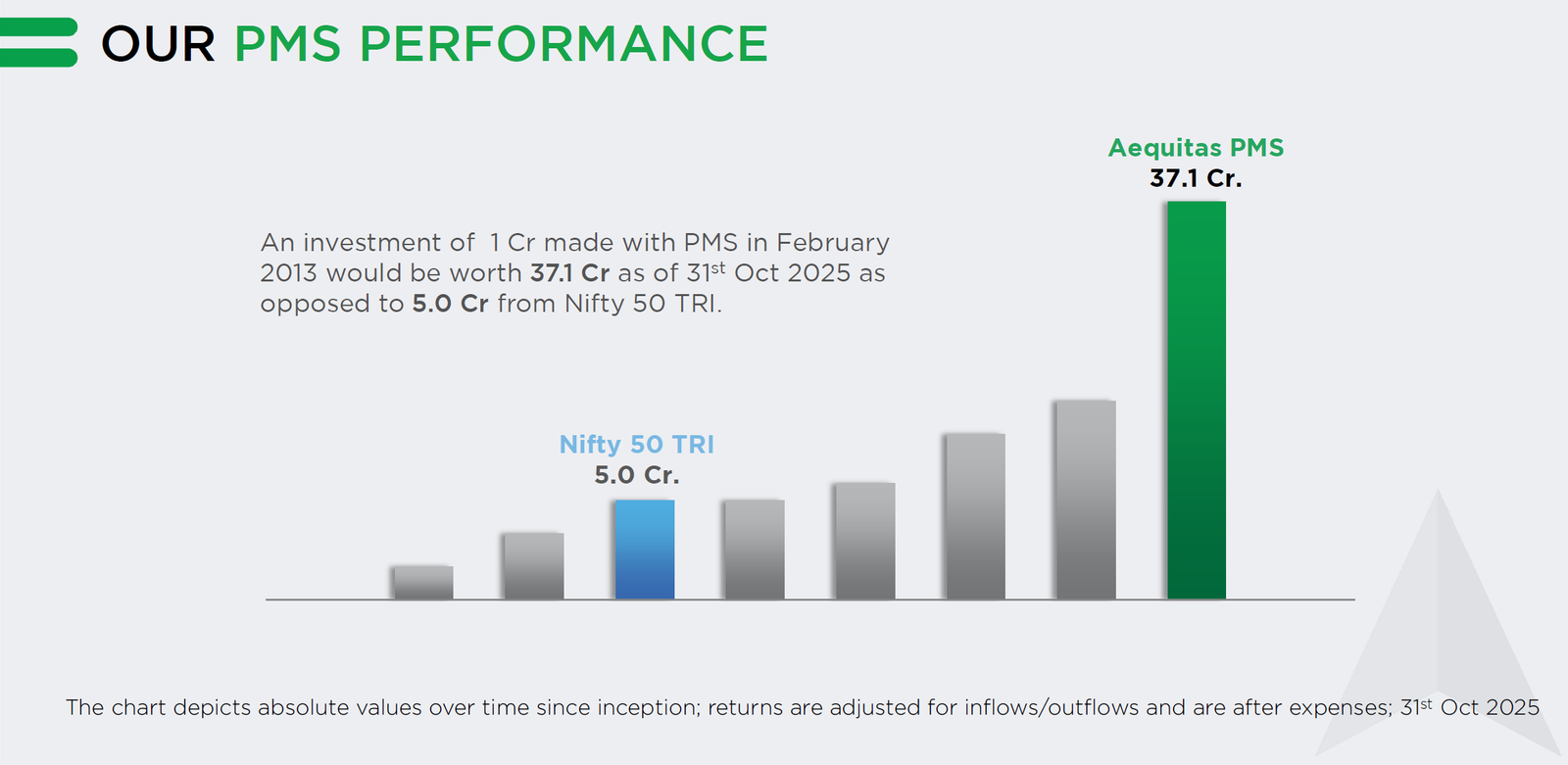

“Aequitas India Opportunities Product” – the best PMS in India offered by Aequitas has delivered a 32% CAGR since inception (Feb, 2013)

Learn more about the types of portfolio management

2. How Portfolio Management Services Works with Aequitas?

Customized Investment Approach

At Aequitas, our PMS fund managers craft personalized investment portfolios tailored to each client’s needs—moving beyond generic, model-based strategies. This ensures a direct, transparent, and collaborative investment experience. PS, ours is a discretionary PMS service in India.

Investing with a Safety Net

Our approach to wealth creation emphasizes a strong margin of safety. We focus on identifying undervalued opportunities with high growth potential, allowing for strategic investments in overlooked assets.

Independent, Data-Driven Research

We rely exclusively on our in-house research process, eliminating dependence on external agencies. This ensures well-informed, data-backed decisions aimed at optimizing returns while effectively managing risk.

3. How to Choose the Best PMS Services in India?

To choose the best PMS service in India, start by defining your investment goals—whether it’s wealth creation, regular income, or capital preservation. Assess the PMS provider’s track record, focusing on consistent returns, benchmark performance, and risk management over 5-10 years. Evaluate the PMS fund manager’s expertise, including their experience, strategy, and market insights. Review the fee structure, ensuring it aligns with your financial goals. Lastly, check for transparency and service quality, including regular reporting and client support. Opt for a PMS that offers a balance of performance, reliability, and personalized service – something Aequitas’ PMS in India offers.

4. How did Aequitas become top PMS in India?

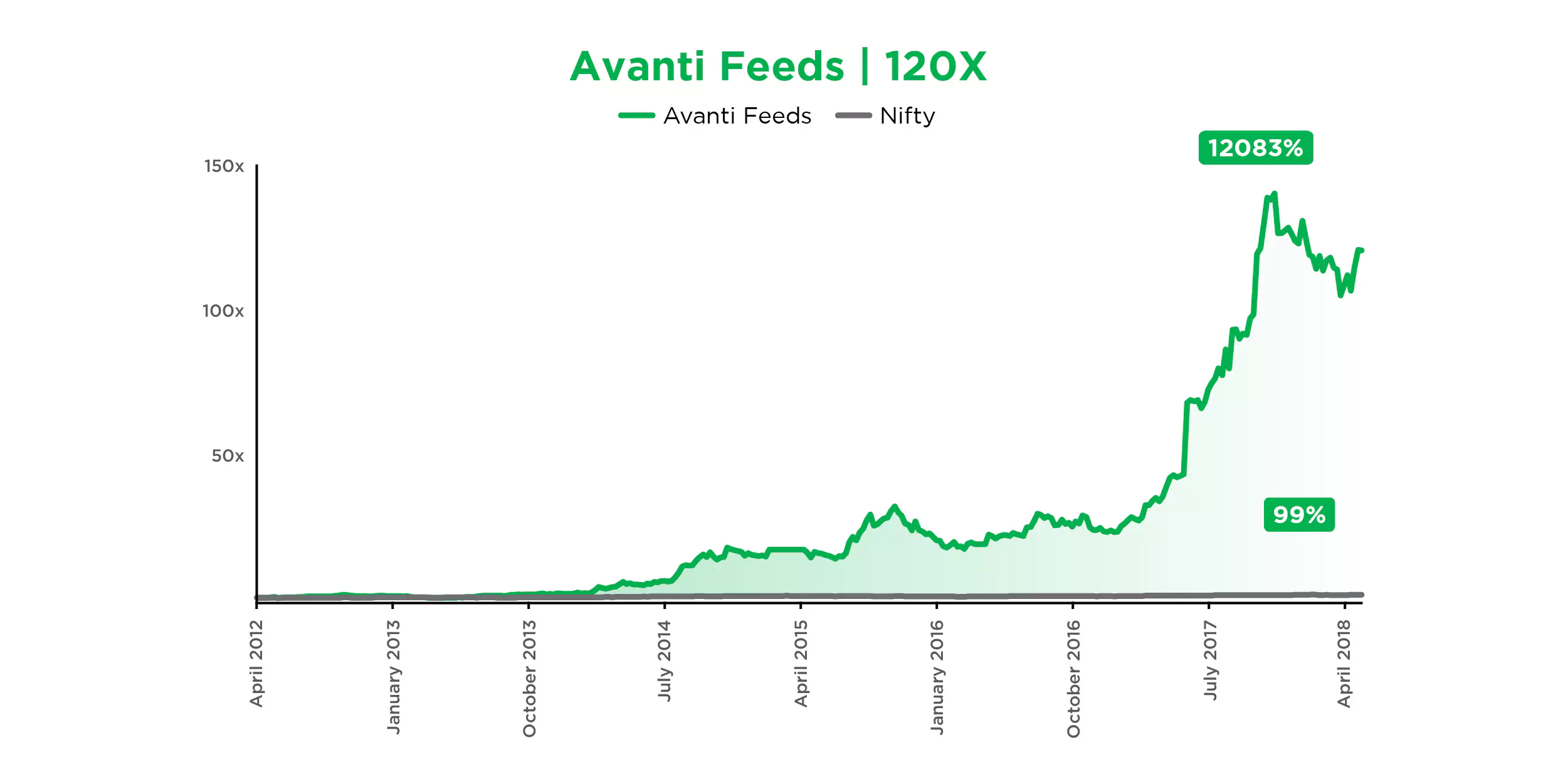

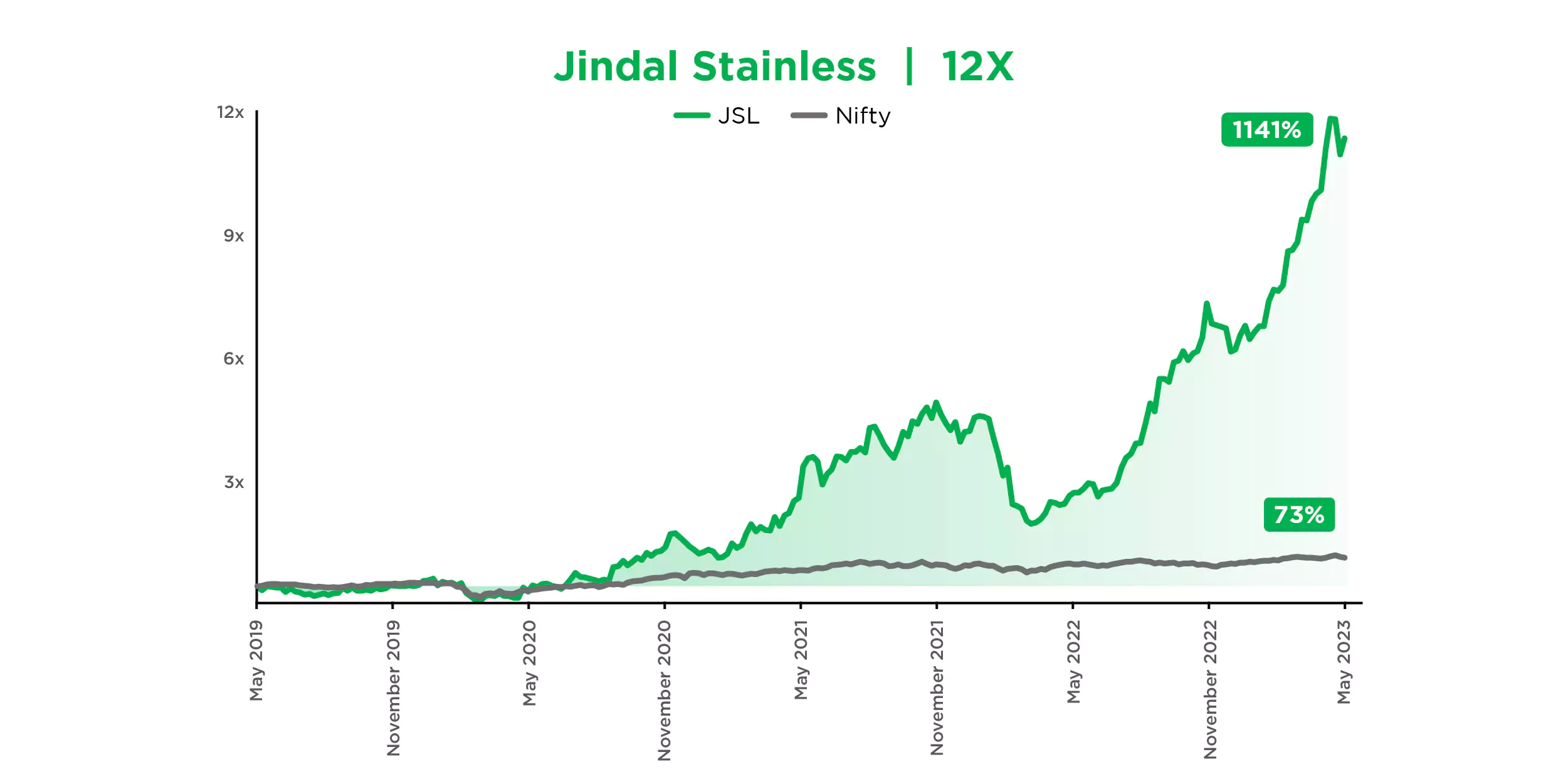

Aequitas stands out as the top Portfolio Management Service (PMS) in India due to its exceptional conviction in the investment process leading to the ability of identifying multi-bagger opportunities in the pool of listed stocks which has generated exponential returns. By identifying high-potential companies early at a lucrative valuation, Aequitas has continuously outperformed index and peers. Key examples of alpha realization include Avanti Feeds Limited, which surged 120x, Apar Industries Ltd with a 37x return, GAEL at 27x, JSL at 12x, and PowerMech at 9x. This remarkable performance is driven by a robust investment strategy, deep research, and a disciplined approach, enabling Aequitas to consistently outperform the market and establish itself as a leader in the PMS landscape.