Author : Aequitas

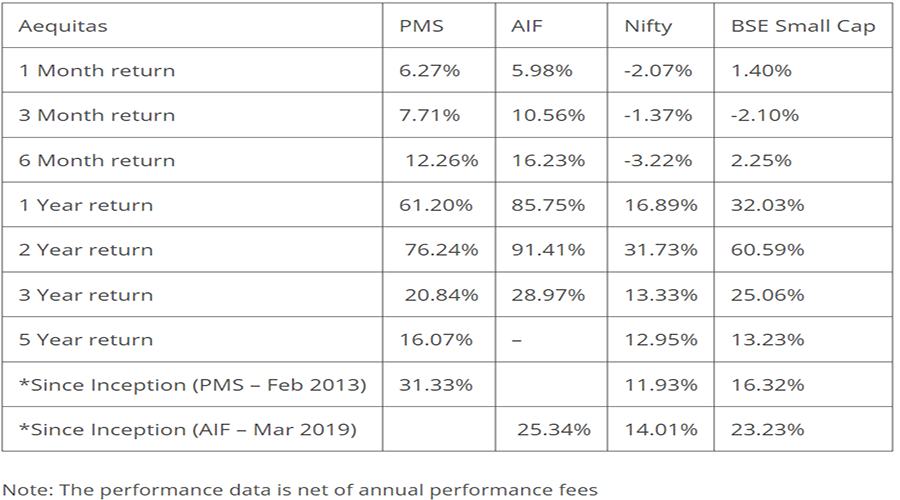

Note: The performance data is net of annual performance fees

Investment Thesis

We are very glad to share that our portfolio positioning is yielding the desired results. Before we set out constructing the portfolio in 2019 (for the AIF), that focused on Infrastructure (Capex part), Metals, Commodities and B2B manufacturing, we had a lot of internal debates within the Research team – the questions were not whether we should enter these sectors, but whether we enter these sectors at this point of time? Entering a party early is as bad as entering the party late. The next few weeks that we debated internally brought about a lot of compelling reasons for us to finally choose these sectors.

Given below is one part of the debate that convinced us that we were on the right path –

We started with the lookout for Structural Growth sectors which over the next 5-7 years would become the most vaunted sectors by the Investors. Needless to say, we had to stand true to our philosophy where we were looking at companies that–

● Had inexpensive valuations

● Had cash on the balance sheet

● Was a sector where companies have a decimated balance sheet which was on the

verge of getting consolidated

● Had high promoter holdings

● And most importantly – we could clearly identify the catalyst that would propel the

company and the

● Sector to future growth which is significantly higher than the previous 10 years.

This month’s newsletter we share with you the methodology of identifying our Structural growth sectors all of which eventually end up as Fads.

It’s like a self-feeding cycle which starts from –

Stage 1 – Sectoral despondence is where companies of the Sector are deep in debt but there is also consolidation that happens, as the Sector can’t absorb so many players. The companies have decimated balance sheets, but with competition receding the ones who are left behind are stronger and start building the business. This is not recognised by the market participants and the stock is labelled “A has been company”.

Stage 2 – Hope – The second stage in this cycle is one where the companies start paying off their debts and consequently show not only EBITDA growth but also EBT or PAT Growth. This again is a stage of ignorance by market participants.

Stage 3 – Revival – The third stage is one where the company starts seeing demand and finally starts adding capacities – but this capacity is being added through internal accruals only, as the company still look at banks as only fair-weather friends and not ones to rely upon when they are in need. The markets start noticing the companies now – we start getting increased Analyst participation in Company Quarterly con-calls and the stock starts getting positive write ups from the early adopters but still is not a part of larger institutions portfolios.

Stage 4 – Secular growth Sector is the fourth stage, when the sector becomes “Hot property” – this is the time when they are really expanding capacities by 100 to 150% in anticipation of demand. By this time, everyone has to say positive things about the company – the balance sheets have revived, the EBITDA margin are growing at a very rapid pace, both top line and PAT reflect growth all across and the investors clamour for the stock. And then the “secular growth” stories start popping up.

Stage 5 – Irrational Exuberance is the last stage, the one which is accompanied by some blockbuster buyout or a merger, which is when normally the Stock price tops out but this is also the time when the Stock attracts the maximum eyes. This is also the stage by when competition looks at the segment afresh and has thrown their hat in the ring, forcing incumbents to either increase marketing spends to hold onto their market share or reduce prices and then the downward spiral begins all over again.

Equity Markets view

The Markets are seeing visible signs of fatigue, with the BFSI segment, IT and Consumption segment, the 3 largest representatives by weight on the Nifty face headwinds.

Banking – Facing the headwinds of change in the interest rate cycle, not only will they have a challenge of seeing their treasury income compress significantly, but Inflation is also eating into household budgets. With most of the banks having focused only on Retail over the past 4-5 years, we feel that there would be some stress and households may not be able to pay their EMIs on time, thus increasing delinquencies.

IT – while COVID made a lot of companies accelerate towards digitization which helped IT companies increase their topline handsomely, the quarter gone by, have seen record attrition levels ranging from 17%-27%. Thus, effectively repricing their entire workforce. With travel opening up and the cost of business building we feel that IT companies will face cost pressures thus bringing about a slowdown.

Consumption Pack – With the shot-up prices of oil, energy, wheat, palm oil, sugar etc., we feel that cost pressures on FMCG companies are near all-time highs. As not only these; but also the fact that the petrochemicals used for their packaging as well, will be hitting their bottom lines. Since they work on very fine margins at an SKU level, we believe that this will either lead to resizing of packages or repricing of existing sizes – both will be at a significant

expense.

Global Interest rate outlook

The Fed has given direction in which they intend to tame their inflation, as well as pare their Balance Sheet. For the next 3 months, they envisage a 50 bps hike starting May, along with a $ 47.5 billion pairing of Balance Sheet which will double after 3 months. They envisage bringing back their Balance sheet to pre-COVID levels by 2024.

While we don’t really know how it will pan out for sure, we believe that the above action has to be seen from a historical perspective. Just like the QE series – where the markets reacted maximum to QE 1 and as we arrived closer to QE 3 – the markets stopped reacting positively to incremental money infusion. Similarly, we think that the first hike will have the maximum impact on the market and as the action of the Fed, which has given a glide path to the market participants of not hiking rates high enough to stall the economy, but to ensure that they take the steam off inflation takes root, we will see the markets finding a footing to start afresh.