Author : Aequitas

Oh, what a year it has been! The best way to describe the year gone by, is to quote the famous lines of ‘A tale of two cities’ by Charles Dickens –

“It was the best of times, it was the worst of times, it was the age of wisdom, it was the age of foolishness, it was the epoch of belief, it was the epoch of incredulity, it was the season of light, it was the season of darkness, it was the spring of hope, it was the winter of despair.”

These lines were lived by all market participants in the past year. The darkness was earlier brought by COVID-19, supply chain issues, the Russo-Ukrainian war and then, the hope was brought by the will of the people to overcome the challenges and go about, with as much as business as usual as they possibly could, during these times. The Central Bankers, who till the first half of the year were revered for their astute calls were caught woefully wrong on what was called ‘Transitory Inflation’.

We saw some very interesting events in the year gone by:

Inflation which started off as being ‘Transitory’ is now ‘Hard coded’ – as US records an increase in housing prices, rents, metals across from lithium to steel, commodities from oil to palm oil – from Wheat to Sunflower oil – everything is on the boil – something that the world has not seen in over 40 years.

Inflationary impact is currently being seen in COVID ravaged Sri Lanka where they are suffering from Twin deficits of Current Account as well as Balance of Payments. There are already emergency lines of credit that have been given by China and India, but the situation is such that we already have Riots happening due to lack of food, potable water, electricity. Deficits in these times can be debilitating for any economy running Current Account Deficits.

We too need to be cautious as a Nation as —

We too are importing Inflation across – whether energy or Palm oil or Gold / other precious metals.

Our fertilizer and Gas subsidy was Budgeted at Rs 1 Lakh Crs (Down from Rs 1.4 Lakh Crs last year) is bound to be significantly overshot.

Impact on rupee due to the Current Account deficit – we touched a gap of $ 43 billion last year when prices were moving low . Given the Inflation across ,the war, the broken supply chains and the people coming back to work, shop, travel and party this is bound to move up sharply. And unlike the last 2 years we may not have the FDI Inflow cushion that we had – given the Monetary tightening that will happen globally. Given the situation, we will be keeping a Hawk’s eye on our Current Account Deficit numbers.

Broken Supply Lines – It started with ‘Evergiven’ getting stuck on the Suez – it served for a lot of memes initially, but little did we know then that it would become symbolic of the ‘Broken supply chains across products’ – whether it was basic goods or intermediate or for that matter high end ‘Semiconductors’ – all faced supply challenges

War – The Russia Ukraine war which exacerbated the energy crises in Western Europe and the rest of the world has divided the Western world more than ever since the Cold War ended. While this event is yet to play out in entirety, we believe that whatever be the end, it will take a long time for us to get back to where we were before the war, in terms of getting back the supply lines to work as they were, before the war.

Atmanirbhar – A ‘good to have’ practice that emanated from COVID-19 was to start diversifying products from a single provider – essentially a move to diversify from China, given the freezing relations between US and China. As the year went by it became more of a ‘Clarion call’ where all nations are moving towards from ‘just in time’ to ‘just in case’ scenarios. India too becoming ‘Atmanirbhar’ (aim for self-sufficiency) in a lot of areas

From globalization to indigenization – From all accounts the World is moving towards de-globalization, from a time when ‘just in time’ is right to a time when ‘just in case’ is the issue being addressed. This will lead to a lot of indigenization’ – which means local control of production of goods irrespective of price. In these times our FTA’s across with the Middle East, Australia and Japan will hold us in very good stead. We believe that there will be more FTAs which India will take advantage off to become a much larger ‘Manufacturing Hub’

Foreign Trade – Our exports in FY ’22 have touched a decent number of over $400 Billion. This along with IT exports of $150 Billion and a remittance number of $80 Billion have given us a lot of comfort. However, with our imports also crossing $600 Billion (outside of Gold imports) there is still a cause for caution.

Action in the markets

Chinks started appearing in ‘Quality Stocks’ which were earlier the ‘Go to’ stocks viz the financials and the consumption stocks

Inflation started eating into FMCG margins and consumers have started downtrading brands for cheaper ones

Metals and mining – 2 highly ignored sectors started to come back into reckoning, this time coming on the back of being ignored by the street for over 10 years. With US, EU, China and India all promising Trillions of dollars of investments either to overhaul their creaking infrastructure or build it from ground up – this story has a lot of leg

Auto is seeing a revolution especially in the two-wheeler space where we are looking for a big growth in Electric Vehicles (EV) – although it will come at the expense of the Two Wheeler (TW) segment losing out on the ICE segment. A lot of new players have entered the segment Ather, Hero electric, Revolt, Ola amongst others who are vying for the spoils. Hence, it remains to be seen as to who will emerge as the winner in this hotly contested space.

IT came back with a bang from hibernation – With a lot of us using apps and WFH becoming a structural phenomenon, Indian IT went up the learning curve and started delivering value added software

Sectoral Performance

The Nifty heavyweights (banks and FMCG) failed to perform and the ones who were underrepresented, shone (metals and media). IT was the only outlier where a high weightage sector grew 40% – contributing approx. to nearly 50% of Nifty growth of 18%.

Outlook going ahead – Equity

For once, giving out the outlook is relatively easy as this is something that we have been saying for quite some while. In fact, we have also positioned our portfolios accordingly. We believe that sectors loved by the markets are cyclical in nature. The love showcased here is like our love for Bollywood actors; it keeps on changing with time. However, investor memory is so short that they tend to forget the past and just focus on the ‘Hottest new Sector / Stock’. At times, we believe that it’s got to do with the ‘Strong Fundamentals and the Secular Growth Stories’ that are fed to them. But unfortunately, the truth is that –

Strong Fundamentals = Price Discovery = Not much more than Market return for investors

More often than not, the Strong Fundamentals are also accompanied with Secular growth Stories. To give you a peek into some interesting stories from our own Stock market history –

Needless to say, that all the “Favoured Sectors” have a few things in common –

● They are at their Peak EBITDA margins – from where they can only go down or at best sustain it for a while

● They are at their peak valuation – Peak valuations give a lot of comfort to most investors as they want to follow the herd

● Most of the money that comes in, comes at the peak of the rally by which time EBITDA margins had already peaked out and what is left is peak P/E multiples. Therefore, investors don’t end up making money

Going Forward–

We believe that the era of ‘easy Money Making’ got over in October 2021; from thereon it has been a Stock Pickers market. Get into the right stocks and you will make decent returns, get into the wrong ones and your portfolio will be signed.

We are looking at Inflation rearing its head again – starting from Oil, Coal, Metals, Wheat, Palm Oil, all raw material is more expensive. This will seep in as higher Raw material costs and bring down EBITDA margins significantly. High P/E stocks in the Consumption space are ones to be avoided.

Our core belief is to enter companies and sectors which are grossly unloved by the markets but are good franchises with good management. We tend to get into these Unloved Sectors much ahead of the Herd, sit tight and wait for the sectors to come back into reckoning. When to enter the sector is the “Secret sauce”. We have been bullish about Infrastructure, Manufacturing and Metals over the past 2 years and have positioned our portfolio accordingly.

With the portfolio positioning now set, we will be monitoring our companies very closely like a Hawk, to see if the company’s business growth happens according to expectations. While we never promise you the best returns every year – we surely endeavour to be in the Top 3 houses over a cycle of 4-5 years.

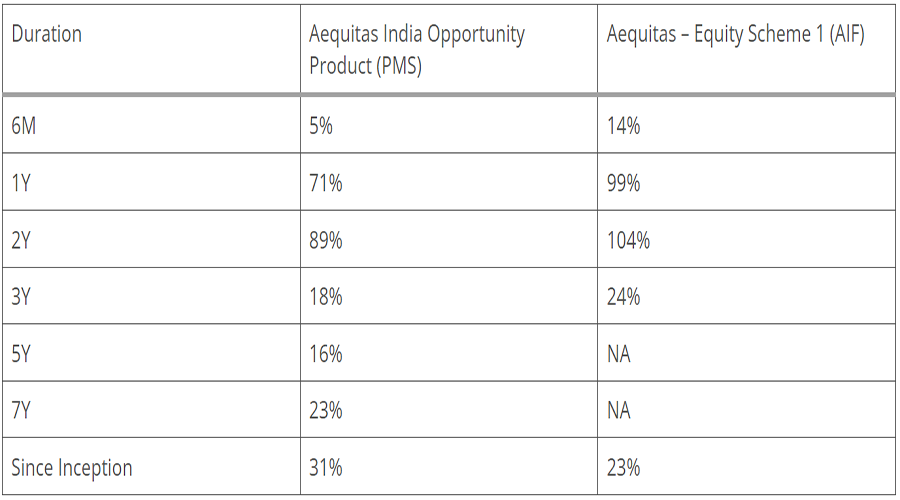

Having said the above, these are the returns that we have generated for our investors in the year gone by –

Both PMS and AIF are Ranked 1 in performance for FY 22 by PMS Bazaar*

View on other Asset Classes

No Annual outlook is complete without a view on other Asset classes – Gold – Gold is yet another Asset class that we believe will do well over the coming years. With nearly $9 Trillion having been printed across the Globe during COVID to stave off the once in a hundred-year challenge posed by a stalled Economy, the Central bankers printed left, right and centre. Having the belief that they had tamed inflation (fun fact – before COVID-19 hit, out of the $ 23 Trillion of bands issued, $18 Trillion were on negative yield). US, EU and Japan were ones who were trying their best to reach their respective inflation targets, and in the end, they got what they were praying for: “Inflation”. Inflation has reached near 40-year highs in these economies. High Inflation has always led to debasement of currency, which should help prop up Gold.

Recommendation – Since Gold Returns are chunky, in the current times, Investors should keep anywhere between 5-10% in Gold from a Tactical perspective.

Crypto’s & NFTs – While both of these have caught the investors fancy, we are of the firm belief that if there is No underlying value in an Asset, we don’t understand how to value it. Something that we don’t understand fully, we would not recommend any investor to own it.

Unlisted Stocks – Whenever we discuss this space, we are drawn to the so many bubbles that we have seen in the past. We believe that there is a very big bubble in the Unlisted (next gen) companies. While we too believe that Next Gen businesses have some very interesting business models, but we are sure that the valuations are through the roof and with Global Quantitative Tightening coming up, we will see liquidity being drawn out of the system and a lot of investors will be left with stakes in companies that will be zombie companies.

Wishing all investors, a very happy and prosperous FY 2023.