Amplify Your Returns

Aequitas Investment is a SEBI-registered Portfolio Management Services (PMS) provider specializing in high-growth small and mid-cap equities in India. With a proven track record of 32% CAGR since 2013, we help investors capture the immense potential of India’s rapidly growing economy.

Aequitas’ investment approach combines growth and value investing to navigate the Indian equity market and emerging markets. By focusing on undervalued stocks with high growth potential, Aequitas targets opportunities in emerging markets that promise long-term, multi-bagger returns.

Our founder

Siddhartha Bhaiya is the Managing Director and Chief Investment Officer at Aequitas.

He is a qualified CA and the driving force behind Aequitas with more than 20 years of experience into Equity Research

and Equity Fund Management. He has been instrumental in taking Aequitas from a start-up to one of

the consistently best performance track-record in the industry. He believes in generating outsized

returns by investing in small cap undiscovered companies. With exposure across all market capitalization

companies, he is a specialist in bottom-up stock selection – the Multibagger approach.

Explore Our Multibaggers: Indian Equity Markets

Apar Industries Ltd. is a leading Indian conglomerate, specializing in the production of conductors, transformer oils, and power and telecom cables.

Multibagger quotient: 37x

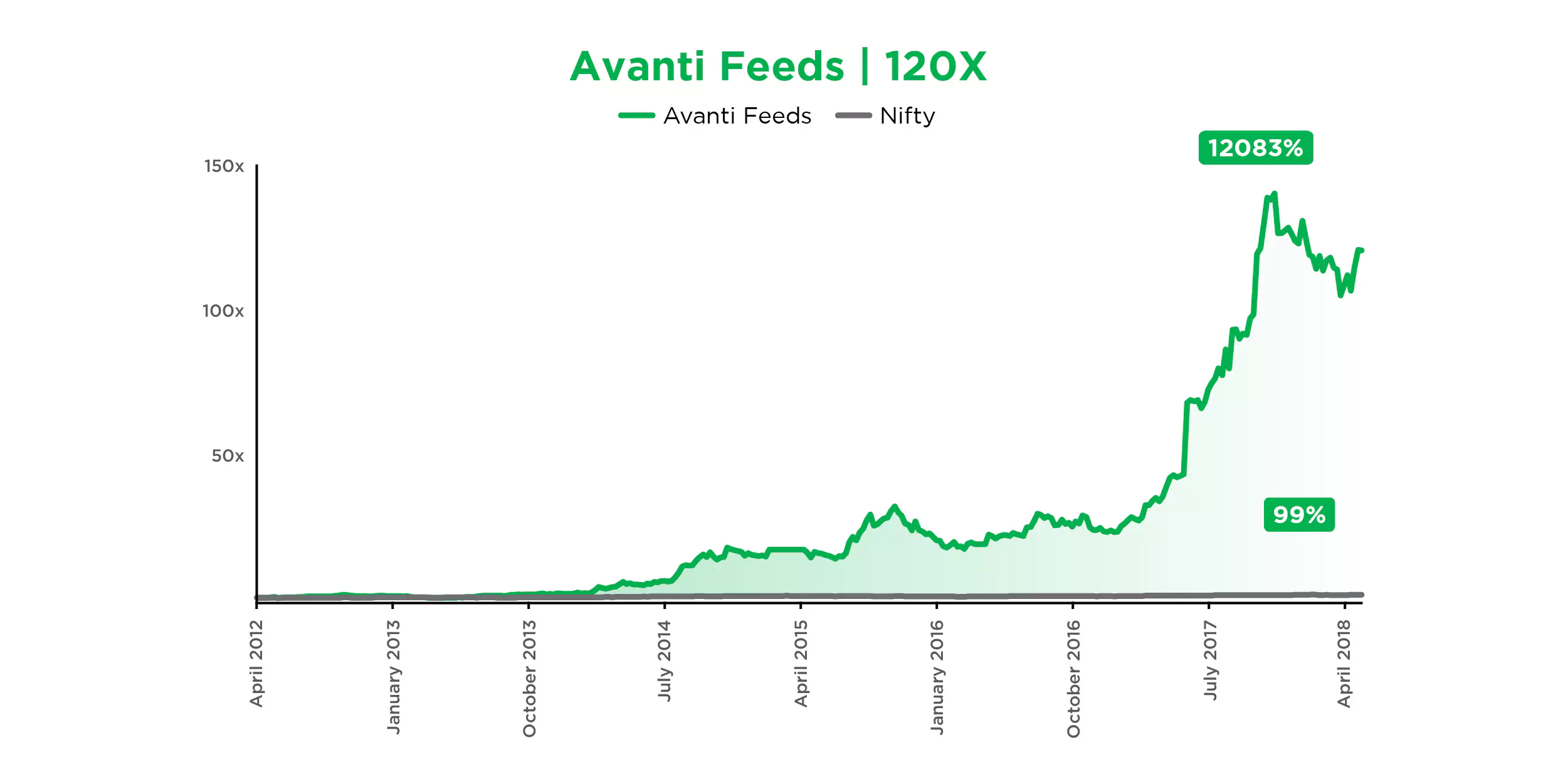

Avanti Feeds Ltd. is a prominent Indian aquaculture company that specializes in shrimp and prawn processing. It is known for its quality seafood products and has a significant presence in the global seafood industry.

Multibagger quotient: 120x

Gujarat Ambuja Exports Ltd. specializes in the export of agricultural products, including spices, seeds, and other food items, and is known for its international market presence and quality products.

Multibagger quotient: 27x

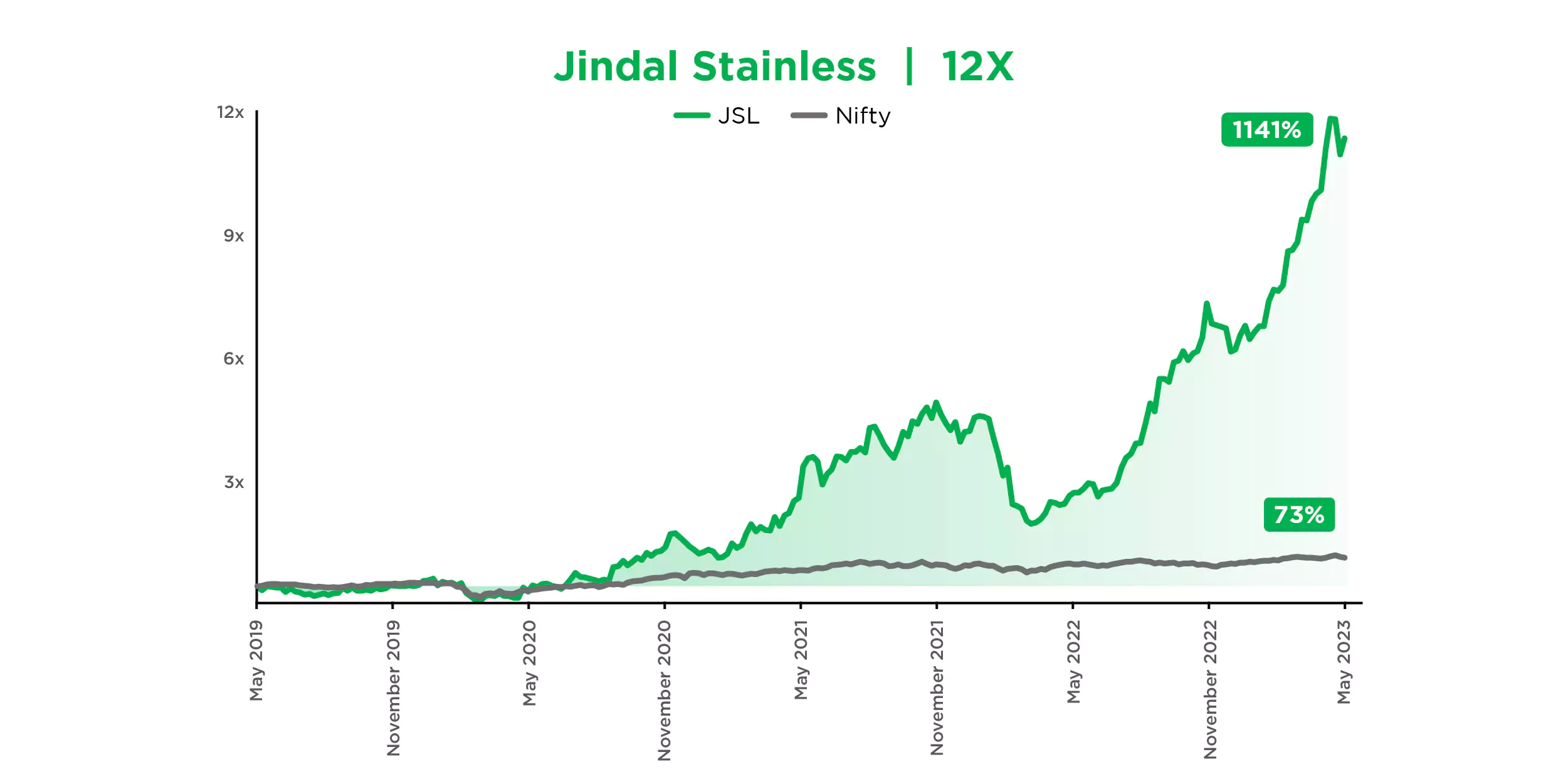

Jindal Stainless Ltd. is one of India's largest stainless-steel manufacturers and a leading global player, renowned for its high-quality stainless-steel products.

Multibagger quotient: 12x

Power Mech Projects Ltd. is a leading Indian infrastructure company specializing in the execution of power projects, industrial boilers, and balance of plant works.

Multibagger quotient: 9x

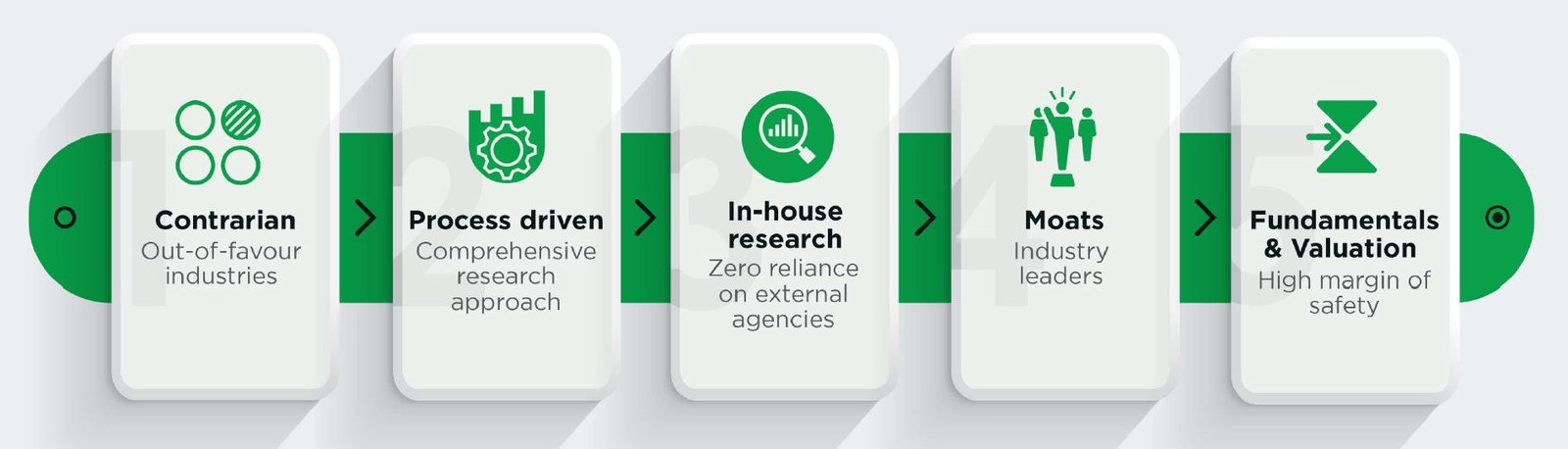

Our Approach

Our investment philosophy is simple, we walk the talk. We believe that savings doesn’t create wealth for you, investing in the right manner does and through a carefully planned strategy, we deliver what we promise.

We focus on facts and fundamentals and ignore market narratives.

We do not chase momentum or hot stocks.

We do not indulge in derivatives or IPOs.

Growth: The company must have above average growth potential for the next 3-5 years.

Contrarian: We do things differently, which is a must to identify Multibaggers.

Value: The valuation must be reasonable with a definite potential of re-rating soon.

Screeners: To analyze fundamental financial metrics

Research: We do our own primary research.

Portfolio Construction: Identify robust stocks, fit across all above parameters.

Ongoing research: Revisit the research timely to take informed decisions.

We aim to construct a portfolio of around quality stocks that are fundamentally strong, with a focus on mid and small cap growth companies, with a horizon of 3-5 years in mind.

Have outperformed large caps through upcycles.

Many large companies started as mid/ small caps.

‘Riskier than large caps’ is a myth.

Industry Leaders

Low Debt

Good Management

Valuations

Creeping Acquisition/ Buy Backs

Cash Flow

Risk equates to what Ben Graham called a “permanent loss of capital”.

There are 3 risks that we particularly focus on:

Alternative Investment Funds (AIFs) in India provide access to private equity, venture capital, hedge funds, and real estate, reducing reliance on traditional stocks and bonds.

AIF are managed by expert alternative investment fund managers who use data-driven strategies to optimize returns and mitigate risks.

The best AIF funds in India invest in high-growth sectors, pre-IPO companies, and innovative industries, offering superior long-term returns.

Top AIFs in India allow access to pre-IPO placements, distressed assets, and high-value private market investments, often unavailable in traditional markets.

AIF funds in India offer pass-through taxation (Category I & II), no dividend distribution tax (DDT), and tailored investment strategies based on risk appetite and financial goals.

Designed for HNI & institutional investors, AIFs cater to those with higher risk tolerance and long-term wealth creation objectives.

Alternative Investment Funds (AIFs) in India provide access to private equity, venture capital, hedge funds, and real estate, reducing reliance on traditional stocks and bonds.

AIF are managed by expert alternative investment fund managers who use data-driven strategies to optimize returns and mitigate risks.

The best AIF funds in India invest in high-growth sectors, pre-IPO companies, and innovative industries, offering superior long-term returns.

Top AIFs in India allow access to pre-IPO placements, distressed assets, and high-value private market investments, often unavailable in traditional markets.

AIF funds in India offer pass-through taxation (Category I & II), no dividend distribution tax (DDT), and tailored investment strategies based on risk appetite and financial goals.

Designed for HNI & institutional investors, AIFs cater to those with higher risk tolerance and long-term wealth creation objectives.

We are a leading investment firm with offices located in Mumbai, GIFT City & Dubai who specialize in global listed equity markets. Our clients comprise over a hundred UHNIs, family offices and global investors. With a net AUM of INR 61 bn., our 10-year CAGR of 28% (for PMS) has significantly outperformed the Nifty all along.

A-1003, The Capital Building, Behind ICICI Bank, BKC, Bandra -East, Mumbai -400051

info@aequitasindia.in

+91 72080 42953

Stay Updated. Stay Ahead