PMS vs AIF – Major Differences Between PMS and AIF You Should Know

Key Takeaways: PMS vs AIF at a Glance

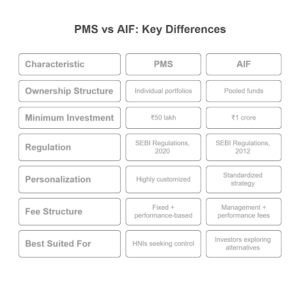

- Ownership Structure: PMS manages individual portfolios; AIF pools funds from multiple investors.

- Minimum Investment: PMS requires ₹50 lakh; AIF requires ₹1 crore (₹25 lakh for angel funds) While this is the minimum threshold, it can vary for each fundhouse.

- Regulation: Both are SEBI-regulated but under separate frameworks (PMS: 2020, AIF: 2012).

- Personalization: PMS offers a more customized approach; AIF operates on a common strategy.

- Fee Model: Both charge management and performance fees, but structures may differ.

- Transparency: PMS offers detailed investor-level reporting; AIF provides fund-level summaries.

- Best Suited For: PMS suits HNIs seeking tailored portfolios; AIFs attract those looking for pooled exposure to alternative assets.

- Offered by: Aequitas is one of the best PMS in India, offering customized portfolio management services to high-net-worth individuals. Aequitas also offers AIF opportunities following the same investment strategy as their PMS and investing in listed equities.

PMS vs AIF – What’s the Real Difference?

For high-net-worth individuals and sophisticated investors exploring advanced investment options, AIF and PMS stand out. While both promise professionally managed portfolios and access to high-growth asset classes, understanding the difference between PMS and AIF is crucial to choosing the right investment avenue.

Let’s explore the core differences between AIF and PMS in terms of structure, flexibility, transparency, and investor suitability.

Quick Comparison: Major Differences Between PMS and AIF

Definition and Structure: PMS vs AIF

Portfolio Management Services (PMS)

PMS refers to professional portfolio management services in India designed to meet the specific goals of individual investors. Each client holds a separately managed account, and investments are tailored according to their risk profile and objectives. PMS can be:

- Discretionary: The fund manager takes all decisions.

- Non-discretionary: The investor directs the decisions.

Explore types of portfolio management services

Alternative Investment Funds (AIF)

AIFs are pooled investment vehicles that collect funds from multiple investors and deploy capital in alternative asset classes like:

- Private equity

- Public equity

- Hedge funds

- Venture capital

- Infrastructure

- Debt instruments

AIFs are structured as trusts, LLPs, or companies and categorized as:

- Category I – Social impact, VC, infrastructure, and SME funds

- Category II – Private equity and debt funds

- Category III – Hedge funds and high-risk strategies

Regulatory Framework: AIF vs PMS

- PMS in India is governed by SEBI (Portfolio Managers) Regulations, 2020, ensuring clear guidelines for transparency, eligibility, and reporting.

- AIFs are regulated under SEBI (Alternative Investment Funds) Regulations, 2012, which prescribe different rules for each AIF category based on the investment strategy and risk.

Minimum Investment: AIF and PMS Compared

Investment Type | Minimum Investment |

PMS | ₹50 lakh |

AIF | ₹1 crore |

| Angel Funds (Cat I AIF) | ₹25 lakh |

PMS requires a lower capital threshold than AIF (except angel funds), making it more accessible to HNIs who are starting with smaller ticket sizes but still want professional portfolio management. While the threshold is chalked out by SEBI, the entry point can vary for each fundhouse.

Explore our detailed guide to PMS minimum investment and AIF minimum investment

Investment Approach and Flexibility: AIF vs PMS

PMS

- Custom-tailored investment strategies

- Direct ownership of securities

- Flexibility to rebalance portfolio as per investor’s risk appetite

- Ideal for investors who want control, transparency, and personalization

AIF

- Pooled structure with a predefined investment strategy

- Limited or no customization

- Decisions by fund manager apply equally to all investors

- Better suited for those seeking exposure to high-potential private markets and niche asset classes

Fee Structure: Difference Between PMS and AIF

Both PMS and AIF adopt a “management + performance fee” model, but the way it’s implemented can vary.

PMS

- Fixed management fee (as % of AUM)

- Performance fee charged above a benchmark return or hurdle rate

- Transparency in billing and deductions

AIF

- Charges depend on fund category and structure

- Category III AIFs may have higher performance-linked fees due to aggressive strategies

- Fees are deducted at the fund level, and reporting may vary in clarity across fund houses

Transparency and Reporting: PMS vs AIF

Criteria | PMS | AIF |

Ownership | Direct ownership by the investor | Owns units in a pooled structure |

| Custom Reporting | Detailed, investor-specific | Fund-level periodic reporting |

| Transaction Log | Provided regularly | Often limited to fund-wide updates |

PMS offers higher transparency in terms of portfolio holdings, transactions, and rationale. AIFs offer less granularity due to the pooled structure.

Risk and Return: Difference Between AIF and PMS

PMS

- Risk and return are highly dependent on the investment strategy and the expertise of the portfolio manager.

- Investors can opt for conservative, balanced, or aggressive strategies based on goals.

AIF

- Category III AIFs often involve high-risk leveraged strategies with potential for high rewards.

- Category I and II AIFs offer moderate risk but may have longer lock-in periods.

- Ideal for investors comfortable with illiquidity and long-term capital commitment.

Who Should Invest in PMS vs AIF?

Criteria | PMS | AIF |

| Best Suited For | HNIs wanting customized portfolios | Investors seeking access to alternative assets |

| Investment Objective | Personalized wealth creation | Exposure to private equity, debt, venture capital |

| Liquidity | Higher (relative to AIFs) | Lower (lock-in varies by category) |

If you’re looking for a PMS company in India that offers personalized portfolio management, research-driven strategies, and strong compliance, Aequitas stands out as one of the best PMS in India for long-term wealth growth and capital preservation. In addition to PMS, Aequitas also offers carefully curated Alternative Investment Funds (AIFs) in India, providing investors access to equities through a structured product with tax-hassle-free solution —making it a comprehensive destination for both PMS and AIF investments in India.

Conclusion: PMS vs AIF – Which One is Right for You?

Understanding the major differences between PMS and AIF is key to aligning your investment with your financial goals.

- Choose PMS if you value control, customization, and frequent portfolio updates. PMS in India is ideal for HNIs seeking direct ownership and portfolio personalization.

- Opt for AIF if you want to explore an alternate structure.

Whether you’re evaluating the best PMS in India or seeking exposure to Category III AIFs, align your choice with your investment goals, risk appetite, and liquidity needs.

Explore Aequitas – One of the Best PMS and AIF Providers in India

Looking to partner with a trusted name in PMS and AIF investments in India?

Aequitas offers tailored portfolio management services in India and expertly managed Alternative Investment Funds (AIFs), catering to the diverse needs of high-net-worth individuals. Backed by in-depth market research, disciplined asset allocation, and a client-first approach, Aequitas delivers consistent performance and helps investors build long-term wealth.

Whether you’re seeking the best PMS in India for personalized strategies or want to explore exclusive opportunities through Category III AIFs, Aequitas provides the expertise and experience you can rely on.

🔗 Explore Aequitas PMS & AIFs

📞 Contact our advisors to discover the right solution—PMS or AIF—based on your financial goals and risk appetite.